5 8: Cost Centers Versus Profit Centers

The aim is to determine the cost of each operation regardless of the location within the unit. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. When the actual quantity is more than the standard quantity, the variance would be unfavorable and vice-versa. Variance analysis can be done in two ways – first through price variance and then through quantity variance. Kia can identify the highly profitable car models by making a comparison of the profit made by each model.

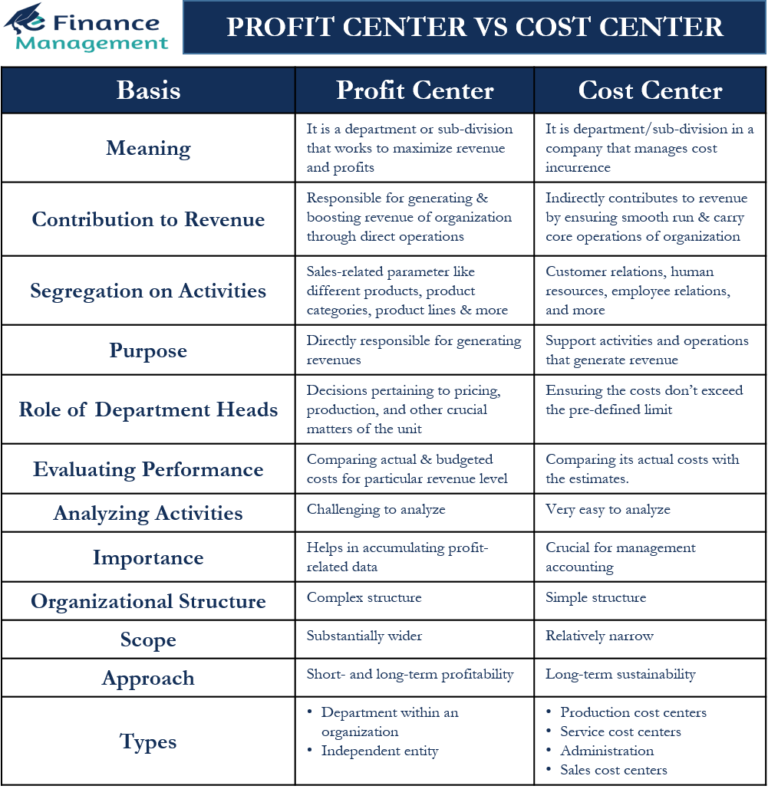

Differences Between Cost Center and Profit Center

For effective control of costs, we divide the factory into various departments. Further, on the basis of the activities performed, these departments are sub-divided into cost centres. In a cost centre, it is pertinent to classify cost into fixed cost and variable cost. On a very similar note, a company often decides to segregate out costs for a project or service-driven endeavor. This project may simply be a capital investment that requires tracking of a single purpose over a long period of time.

Cost Centers – Examples of Companies Operating as Cost Centers and Profit Centers

In addition, they are tasked with identifying cost-saving opportunities and implementing measures to reduce expenses. Profit centers are evaluated based on their ability to generate revenue and profits, and their success is measured by KPIs such as revenue growth, gross margin, and net income. A profit center is a reporting unit of a business that is responsible for profits generated. An example of a profit center is a subsidiary, which is responsible for the amount of sales generated, as well as all costs incurred.

Authority of department heads

- The management team focuses on minimizing expenses and increasing productivity, as their performance is evaluated based on how well they can manage costs.

- It can help identify areas for improvement and ensure that the organization is moving toward its overall goals.

- The focus ofmanagement of a business is generally to limit costs of a cost center withoutimpacting it functions.

- Many start-ups may argue that there’s no need to keep cost centers within the organization since they incur many costs and don’t generate direct profits.

A cost center is a subunit (or a department) that takes care of the company’s costs. The primary functions of the cost center are to control the company’s costs and reduce the unwanted costs the company may incur. The concept of a profit center is a framework to facilitate optimal resource allocation and profitability.

Key Differences Between Cost Centre and Profit Centre

They are typically more focused on sales and marketing and may require additional resources to generate revenue. Some examples of profit centers include product lines, business units, and divisions. On the other hand, revenue generation is a primary objective for profit centers, as their main focus is generating revenue and profits for the company. Profit centers have the authority and autonomy to make strategic decisions, set prices, and manage costs to maximize revenue and profitability. Cost centers typically have limited resources allocated to them, as their primary objective is to manage costs and expenses effectively.

Strategies for Effective Management of Profit Centers – The Key Differences Between Cost Centers and Profit Centers

For instance, a company may feel an IT department is too large of a cost center and may want to break out employees by more dedicated services. Companies may opt to include or exclude the costs necessary for the service cost center to be successful. Expense segmentation into cost centers allows for greater control and analysis of total costs.

In a retailstore, different product categories may be different profit centers. In an ITconcern, profit centers may be categorised on various parameters such as saleof products and sale of services, local and export sales etc. Departments are generally classified on the basis of theirfunctions and their contribution to the business.

For this reason, cost-center accounting falls under managerial accounting instead of financial or tax accounting. Cost and profit centers are essential tools for organizations to achieve their goals. Align incentives for profit center managers and staff members with the organization’s how to create a business succession plan overall financial goals. It might include performance-based bonuses, commissions, and other incentives. Many start-ups may argue that there’s no need to keep cost centers within the organization since they incur many costs and don’t generate direct profits.